inmoveclub.ru Tools

Tools

Cambio De Dollars

Current exchange rate US DOLLAR (USD) to MEXICAN PESO (MXN) including currency converter, buying & selling rate and historical conversion chart. inmoveclub.ru has nearly 20 years of experience providing accurate currency conversion and exchange rates for free. Convert US Dollars to North American. Today Sunday, August 25, the average US Dollar exchange rate in Mexico is 1 Dollar = Pesos. ⇨ 0%. Buy Sell Accede a una calculadora rápida y sencilla para convertir una divisa a otra usando los tipos de cambio en directo más recientes. Taxa de Câmbio. Última Actualização: 23/08/, Moeda, Compra, Venda 1 USD Dolar equivale a Metical. USD - Dolar; ZAR - Rand; EUR - Euro. Dólar dos Estados Unidos (USD). refresh. Exchange result. Convert from: Real/BRL () Value to convert: To: Dólar dos Estados Unidos/USD () Exchange. Get the latest 1 Mexican Peso to US Dollar rate for FREE with the original Universal Currency Converter. Set rate alerts for to and learn more about Mexican. Exchange rate to pay obligations entered into in U.S. dollars payable in México DEL TIPO DE CAMBIO DE CIERRE DE JORNADA". 3/ These exchange rates are. US Dollars to Mexican Pesos conversion rates ; 10 MXN, USD ; 25 MXN, USD ; 50 MXN, USD ; MXN, USD. Current exchange rate US DOLLAR (USD) to MEXICAN PESO (MXN) including currency converter, buying & selling rate and historical conversion chart. inmoveclub.ru has nearly 20 years of experience providing accurate currency conversion and exchange rates for free. Convert US Dollars to North American. Today Sunday, August 25, the average US Dollar exchange rate in Mexico is 1 Dollar = Pesos. ⇨ 0%. Buy Sell Accede a una calculadora rápida y sencilla para convertir una divisa a otra usando los tipos de cambio en directo más recientes. Taxa de Câmbio. Última Actualização: 23/08/, Moeda, Compra, Venda 1 USD Dolar equivale a Metical. USD - Dolar; ZAR - Rand; EUR - Euro. Dólar dos Estados Unidos (USD). refresh. Exchange result. Convert from: Real/BRL () Value to convert: To: Dólar dos Estados Unidos/USD () Exchange. Get the latest 1 Mexican Peso to US Dollar rate for FREE with the original Universal Currency Converter. Set rate alerts for to and learn more about Mexican. Exchange rate to pay obligations entered into in U.S. dollars payable in México DEL TIPO DE CAMBIO DE CIERRE DE JORNADA". 3/ These exchange rates are. US Dollars to Mexican Pesos conversion rates ; 10 MXN, USD ; 25 MXN, USD ; 50 MXN, USD ; MXN, USD.

The dollar is the legal tender in the United States –the country where it is minted- but also of other countries such as Ecuador, El Salvador or Zimbabwe. Ver otros gráficos en vivo de divisas Forex y Tipo de cambio Peso Mexicano Dólar Histórico. ×. Tasas de Cambio ; Estados Unidos · Dólar (USD) Canales Digitales*, , ; Europa, Euro (EUR), , ; Canadá, Dolar Canadiense (CAD), , Tasa de cambio del dolar USD a CUP según elTOQUE: ; Tasa de cambio del euro EUR a CUP según elTOQUE: ; Tasa de cambio del MLC a CUP según elTOQUE: 1 USD To MXN Convert United States Dollar To Mexican Peso. 1 USD = MXN Aug 25, UTC. Send Money. Check the currency rates against all the. Welcome to Texas Money Exchange, your trusted destination for seamless currency exchange services. With competitive rates, personalized assistance. Accede a una calculadora rápida y sencilla para convertir una divisa a otra usando los tipos de cambio en directo más recientes. n3/ A partir del entró en vigencia el denominado Tipo de Cambio de Referencia del Banco Central de Costa Rica. n4/ Para efectos del tipo de cambio. Operational exchange rates for one United States Dollar (USD) listed by country. El Salvador, USD, US Dollar, 1, 15 Aug , History. Equatorial Guinea, XAF. This currency rates table lets you compare an amount in US Dollar to all other currencies. Calculator to convert money in Mexican Peso (MXN) to and from United States Dollar (USD) using up to date exchange rates. With our currency converter, you can view today's exchange rate of various foreign currencies. Learn how much your foreign currency is worth in US dollars. Popular CurrenciesCollapse ; EUROZONE, EURO (EUR) 1 EUR = USD ; GREAT BRITAIN, POUND (GBP) 1 GBP = USD ; HONG KONG, DOLLAR (HKD) 1 HKD = USD. Say goodbye to casas de cambio. Say goodbye to commissions on spending Sending balance by SPEI and having pesos automatically exchanged for digital dollars at. Converting US dollars to euros is a fairly simple process. Typically, there are two ways you can make the conversion. Use a Currency Calculator. When you're. EN. БългарскиČeštinaDanskDeutschEλληνικάEnglishEspañolEesti keelSuomi Euro exchange rates · First progress report on the preparation phase of a. Several countries use the U.S. dollar as their official currency, and many others allow it to be used in a de facto capacity. It's known locally as a buck or. Latest Currency Exchange Rates: 1 Mexican Peso = US Dollar · Currency Converter · Exchange Rate History For Converting Mexican Pesos (MXN) to Dollars (USD). Currency exchange. · Mexican super peso overshadows the dollar internationally · Mexican peso (MXN) to U. S. Dollar (USD) exchange chart · Argentine pesos and. Current exchange rate US DOLLAR (USD) to PERUVIAN SOL (PEN) including currency converter, buying & selling rate and historical conversion chart.

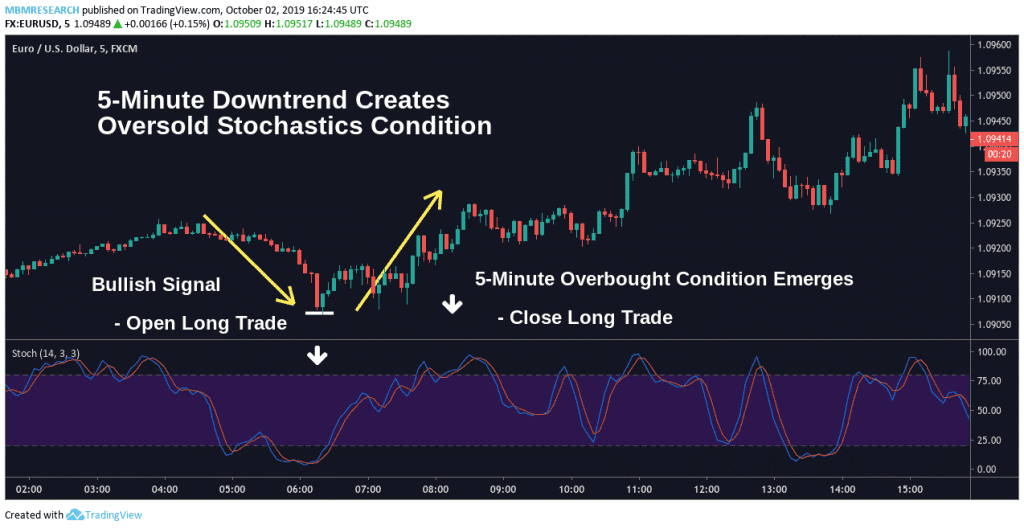

Scalping Futures Strategy

Book overview · Scalping Stocks and Futures: Making Money With discusses some of the major scalping strategies available to you as a trader. · These strategies. This strategy requires traders to make multiple trades throughout the day, taking advantage of small price fluctuations in the market. While scalping can be. What Is Scalping in Trading? Scalping is a trading style that specializes in profiting off small price changes and making a fast profit off reselling. The Forex scalping strategy focuses on achieving small winnings from currency fluctuations. Scalpers usually use short time frame charts. Since it involves quick entry and exit to skim off small profits, it is called scalping trading. The traders who adopt this trading style are known as scalpers. A basic price action scalping strategy can begin by identifying support and resistance- recent swing highs and lows. Recent data is more significant than past. Scalping with the use of such an oscillator aims to capture moves in trending market, ie: one that is moving up or down in a consistent fashion. Generally, Scalping is a focused technique that involves making a minuscule trade to generate profits within a short period of time. This method. The point isn't determining if the price will go up or down. Scalping is identifying small moments of movement as they happen and capitalizing. Book overview · Scalping Stocks and Futures: Making Money With discusses some of the major scalping strategies available to you as a trader. · These strategies. This strategy requires traders to make multiple trades throughout the day, taking advantage of small price fluctuations in the market. While scalping can be. What Is Scalping in Trading? Scalping is a trading style that specializes in profiting off small price changes and making a fast profit off reselling. The Forex scalping strategy focuses on achieving small winnings from currency fluctuations. Scalpers usually use short time frame charts. Since it involves quick entry and exit to skim off small profits, it is called scalping trading. The traders who adopt this trading style are known as scalpers. A basic price action scalping strategy can begin by identifying support and resistance- recent swing highs and lows. Recent data is more significant than past. Scalping with the use of such an oscillator aims to capture moves in trending market, ie: one that is moving up or down in a consistent fashion. Generally, Scalping is a focused technique that involves making a minuscule trade to generate profits within a short period of time. This method. The point isn't determining if the price will go up or down. Scalping is identifying small moments of movement as they happen and capitalizing.

A forex scalping strategy involves buying a currency pair at a low price and then re-selling for a profit, or vice-versa, often within a matter of seconds or. Given the impetus placed on these attributes, West Texas Intermediate crude oil futures (WTI) are an ideal product for the pursuit of short-term market share. A basic price action scalping strategy can begin by identifying support and resistance- recent swing highs and lows. Recent data is more significant than past. Trading Stocks, Commodities, Futures, Options on Futures, and retail off exchange foreign currency transactions involves substantial risk of loss and is not. Scalping is a trading strategy designed to harvest small gains repeatedly to secure long-run profitability. Markets that feature consistent liquidity and. Scalping (trading) · a legitimate method of arbitrage of small price gaps created by the bid–ask spread, or · a fraudulent form of market manipulation. In the fast-paced world of futures trading, various strategies are employed by traders to capitalize on market movements. One such strategy is scalping. Scalp trading, or stock scalping, is a hyper-short-term trading strategy that requires investors to buy and sell securities quickly. People do this at high. The fundamental conception in scalping is to trade liquid assets with tight spreads several times during one day. The trader pays their full attention to the. The scalper will buy large quantities of A, say 10, shares, and sell them when the price increases. For instance, buy and sell the stock of A at every. Scalping is a trading style that profits from small price changes in any financial instrument, be it for example stocks, oil or FOREX. The time horizon is very. Scalping is a day trading strategy where an investor buys and sells an individual stock multiple times throughout the same day. It is a. Zigzag Strategy · Choose your starting point and set your percentage price movement · Identify any swings that differ from the price movement and are greater. Given the impetus placed on these attributes, West Texas Intermediate crude oil futures (WTI) are an ideal product for the pursuit of short-term market share. Scalping is a short-term trading strategy where market participants aim to profit from small, rapid price movements in financial markets. The main goal is to. Intraday Scalping: Futures Markets, Technical System, Trading Strategy for Ranges, Futures Markets, Day Trade Options [Liam Elder] on inmoveclub.ru Scalping" refers to a range of strategies based on many trades with short holding periods and small profits. According to the motto "mass instead of class". Learn futures scalping strategy @ ₹ - Best scalping trading course to learn how to use scalping to trade futures with Donchian channels & Chikou. Typically used for trading Futures, scalping can be done with multiple investments products. Check out the do's and don'ts when scalping and get trading! The 1 Minute Scalping Strategy is a precise trading style, focusing on a 1-minute time frame. It depends on market volatility to capitalize on rapid price.

How Hard Is It To Get A New Construction Loan

Some will also require bank statements. Home construction can be a long process, and the lender needs assurance that you will be able to make payments as the. Stand-alone construction: This is two separate loans. The first loan funds construction. Then when the home is built, you get a permanent mortgage to pay off. Usually, borrowers need to have good credit with a score of at least to qualify for a construction loan. The exact credit requirements can vary by lender. Start building your new home with a TD Bank construction loan! We make it easy to finance your new home with competitive rates, friendly service and. A construction loan is a short-term loan that can be used to cover the cost of building a brand-new home. Typically, the funds get disbursed in increments as. So you'll have two total loans for your house (a construction loan and a permanent loan) but not at the same time. We walk customers through this all the time. Strong credit score: You'll generally need a credit score or higher to qualify for a construction loan. Reasonable debt-to-income ratio: Your debt-to. FHA Single Close Construction Loans: These loans are backed by the Federal Housing Association and are designed as a resource for borrowers who may have less-. Loan Requirements. It is more difficult to qualify for a construction loan than a traditional loan because the completed home is not available to secure the. Some will also require bank statements. Home construction can be a long process, and the lender needs assurance that you will be able to make payments as the. Stand-alone construction: This is two separate loans. The first loan funds construction. Then when the home is built, you get a permanent mortgage to pay off. Usually, borrowers need to have good credit with a score of at least to qualify for a construction loan. The exact credit requirements can vary by lender. Start building your new home with a TD Bank construction loan! We make it easy to finance your new home with competitive rates, friendly service and. A construction loan is a short-term loan that can be used to cover the cost of building a brand-new home. Typically, the funds get disbursed in increments as. So you'll have two total loans for your house (a construction loan and a permanent loan) but not at the same time. We walk customers through this all the time. Strong credit score: You'll generally need a credit score or higher to qualify for a construction loan. Reasonable debt-to-income ratio: Your debt-to. FHA Single Close Construction Loans: These loans are backed by the Federal Housing Association and are designed as a resource for borrowers who may have less-. Loan Requirements. It is more difficult to qualify for a construction loan than a traditional loan because the completed home is not available to secure the.

How Do New Construction Loans Work? · New Construction Loan Requirements · Begin with a Plan · Make Sure You Have Established Credit · Debt to Income Ratio. Start with your local bank where you already have a relationship. Also speak with other local banks, including community banks, credit unions, and cooperative. Credit score—Typically, a good to excellent credit score is required to secure a construction loan— or higher. · Income—Your lender will want to make sure you. A strong credit score: in order to qualify for a home construction loan, you will need to have a strong credit score. Lenders will use your credit score as one. In fact, a bank may ultimately deny your construction loan if you're right at that 80 percent threshold but don't have steady cash flow (because: more risk). How to Get a Loan to Build a House You will need strong credit and a minimum down payment of 10% at closing. The exact down payment requirement is determined. You generally only need to be preapproved and provide a deposit. Once the builder finishes the home, you'll then need to get a mortgage. While such homes offer. If so, you have a wide range of options open to you. Some are surprised to learn that those options include the ability to build a home on your own lot using a. When applying for a construction loan, the minimum credit score requirement is , but some lenders might look for a higher credit score such as A higher. You'll need to prove that your home-building project is real, viable, and relatively low-risk for the lender. For most construction loan applications, you'll. Good Credit Score; Proof of Income; Down Payment; Detailed Plan of Construction Project, including builder and estimated final appraisal value of home. Let's. Because there's no collateral (yet!), the bar to qualify for a construction loan is higher than your typical mortgage. It must be your primary residence and you. In , the average down payment for strong credit on a new home construction loan is 20% of the construction cost. get an appraisal value of your future. With ground-up construction loans, you can typically expect a shorter term – generally up to a year-, but at a higher interest rate. If you've already purchased. Are construction loans difficult to get? They may be more difficult to get without a previous banking history because of the lack of collateral (a finished home). This establishes checkpoints for when we'll disburse funds to your builder. Typically, new builds have 4 to 6 scheduled draws for milestones in the building. How do I know I'll qualify for a loan? Our guidelines look for a minimum credit score of or higher with a record of making timely payments along with a good DTI. Home loan rates can partially be. Construction loans and mortgages, especially, require good credit to get approved, so make sure to review your credit report many months before you're in the.

Stock Options Trade On The

Options trading at Fidelity lets you pursue market opportunities intelligently. Apply to trade options. Last: The last trade price of the underlying asset. Change: The difference between the underlying asset's current price and the previous day's settlement price. An option is a contract that represents the right to buy or sell a financial product at an agreed-upon price for a specific period of time. Stock options are traded on a number of exchanges. List of Equity options on German underlyings ; Deutsche Telekom AG, TKQ, DTE GY ; inmoveclub.ru SE, EOQ, EOAN GY ; Fresenius SE & Co KGAA, FSQ, FRE GY ; Muenchener Rueckver. Options can be useful instruments in various trading strategies. When bought, they give you the right, but not the obligation, to buy or sell an underlying. How to trade options in 5 steps · Step 1. Figure out how much risk you are willing to take · Step 2. Identify what you want to trade · Step 3. Pick a strategy. An equity option is a contract that conveys to its holder the right, but not the obligation, to buy (in the case of a call) or sell (in the case of a put). The NYSE operates two options markets: NYSE American Options and NYSE Arca Options. NYSE options markets have been in business for over 45 years. Options trading at Fidelity lets you pursue market opportunities intelligently. Apply to trade options. Last: The last trade price of the underlying asset. Change: The difference between the underlying asset's current price and the previous day's settlement price. An option is a contract that represents the right to buy or sell a financial product at an agreed-upon price for a specific period of time. Stock options are traded on a number of exchanges. List of Equity options on German underlyings ; Deutsche Telekom AG, TKQ, DTE GY ; inmoveclub.ru SE, EOQ, EOAN GY ; Fresenius SE & Co KGAA, FSQ, FRE GY ; Muenchener Rueckver. Options can be useful instruments in various trading strategies. When bought, they give you the right, but not the obligation, to buy or sell an underlying. How to trade options in 5 steps · Step 1. Figure out how much risk you are willing to take · Step 2. Identify what you want to trade · Step 3. Pick a strategy. An equity option is a contract that conveys to its holder the right, but not the obligation, to buy (in the case of a call) or sell (in the case of a put). The NYSE operates two options markets: NYSE American Options and NYSE Arca Options. NYSE options markets have been in business for over 45 years.

Search the stock or ETF you'd like to trade options on using the search bar (magnifying glass) · Select the name of the stock or ETF · Select Trade on the stock's. Search the stock or ETF you'd like to trade options on using the search bar (magnifying glass) · Select the name of the stock or ETF · Select Trade on the stock's. In finance, an option is a contract which conveys to its owner, the holder, the right, but not the obligation, to buy or sell a specific quantity of an. Discover TradeStation's professional-grade options trading tools, built foradvanced option traders seeking value and power. Learn how to get started. Options are contracts that offer investors the potential to make money on changes in the value of, say, a stock without actually owning the stock. Listen to Stock Market Options Trading on Spotify. Join our trading community over at inmoveclub.ru to improve your stock and. Options trading on Robinhood. Plus advanced charts, no contract fees, and some of the lowest margin rates in the industry. Your step-by-step guide to trading options. Find an idea. Choose a strategy. Enter your order. Manage your position. We'll help you build the confidence to. We'll help you keep on top of your money with intuitive tools for trading options on stocks, indexes, and futures. Let's dive into the world of options so we can understand how these complex investments work, and how to trade them using the Questrade Edge platforms. Orders and bids and offers shall be open and available for execution as of am Eastern Time and shall close as of pm Eastern Time except for option. Remember, a stock option contract is the option to buy shares; that's why you must multiply the contract by to get the total price. The strike price. One option represents shares of a given stock. Options have a strike price and an expiration date. The strike price is the price that the. eToro puts the power of options trading in the palm of your hand — all while simplifying the process for beginners and experts alike. Stock options are contracts that give the owner the right -- but not any obligation -- to buy or sell a stock at a certain price by a certain date. Smiling. The list below includes some major stocks and exchange-traded funds (ETFs) with heavy options volume. It ranks symbols by their average daily call and put. RULE (a) Rule 6 shall be applicable to the trading on the Exchange of options contracts issued by the Options Clearing Corporation, the terms and. Episodes · The Psychology of Automated Trading w/ Mike Christensen of inmoveclub.ru · For Every Strategy, Cash Is A Position · What the Books. Stock options are contracts that give the owner the right -- but not any obligation -- to buy or sell a stock at a certain price by a certain date. Smiling. Options trading is the act of buying and selling options. These are contracts that give the holder the right, but not the obligation, to buy or sell an.

War Bonds

You could purchase a $25 War Bond for $ The government would take that money to help pay for tanks, planes, ships, uniforms, weapons, medicine, food, and. The strength of the Statue of Liberty's grasp on her torch is matched by the clutch of an American's fist of war bonds in this dynamic and effective WWII. Well a war bond is just individual citizens lending the government money. You know, you give your money to the government and in six to ten years time they pay. Wars are expensive, necessitating large expenditures for munitions, supplies, and labor. The American Civil War was no exception, and as the war dragged on. Well a war bond is just individual citizens lending the government money. You know, you give your money to the government and in six to ten years time they pay. U.S. War bonds basically are one of many schemes to control inflation. They don't finance the war in the conventional sense. In buying war bonds. On April 28, , only twenty-two days after the US entered the war, McAdoo announced the Liberty Loan Plan to sell Liberty Bonds to fund the war. The plan had. The $25 bonds became the most publicized and most popular, selling for $ and maturing over a ten-year period to pay the bondholder $ Beginning in According to this announcement, war bonds were as sound an investment as passbooks but with five per cent interest they guaranteed higher yields and – being. You could purchase a $25 War Bond for $ The government would take that money to help pay for tanks, planes, ships, uniforms, weapons, medicine, food, and. The strength of the Statue of Liberty's grasp on her torch is matched by the clutch of an American's fist of war bonds in this dynamic and effective WWII. Well a war bond is just individual citizens lending the government money. You know, you give your money to the government and in six to ten years time they pay. Wars are expensive, necessitating large expenditures for munitions, supplies, and labor. The American Civil War was no exception, and as the war dragged on. Well a war bond is just individual citizens lending the government money. You know, you give your money to the government and in six to ten years time they pay. U.S. War bonds basically are one of many schemes to control inflation. They don't finance the war in the conventional sense. In buying war bonds. On April 28, , only twenty-two days after the US entered the war, McAdoo announced the Liberty Loan Plan to sell Liberty Bonds to fund the war. The plan had. The $25 bonds became the most publicized and most popular, selling for $ and maturing over a ten-year period to pay the bondholder $ Beginning in According to this announcement, war bonds were as sound an investment as passbooks but with five per cent interest they guaranteed higher yields and – being.

Even at the war's end they averaged only $) But they often had loose change they could use to purchase a 25 cent stamp which could be pasted into a book. War Bond. California Common · War Bond California Common · *10% Case Discount included in 24 pack price* · Style: California Common Format: 4 x 16oz. ABV: %. War bonds are debt securities issued by a government to finance military operations and other expenditure in times of war without raising taxes to an. War Bonds are debt instrument (bonds) that are issued by governments to finance military operations and production in wartime. A war bond is is a form of government debt that seeks to raise capital from the public to fund war efforts. War bonds were as sound an investment as passbooks but with five per cent interest they guaranteed higher yields. In Memory of the War Bonds you Didn't buy. · Download. Rights. No Re-Use. In Copyright. More Rights Info. Small JPG px · Medium JPG px · Large JPG 1,px. WAR BOND DRIVES. The campaigns to encourage Americans to buy U.S. Treasury bonds to finance World Wars I and II were known as war bond drives. Because mass. A war bond refers to a government-issued financial instrument utilized to finance military operations in periods of war or strife. War Bonds is a spectacular story, very moving and emotional. One may think of War Bonds as those bonds that people buy during the war to help finance the war. Buying war bonds would help parents protect children from Nazi oppression. War Bonds image courtesy Northwestern University Library The federal government spent. Following the attack on Pearl Harbor, Defense Bonds became known as War Savings Bonds, or informally as War Bonds. War Stamps were also introduced in small. Wyeth, N. C., Artist, and Funder United States Department Of The Treasury. Buy War Bonds. United States, [Washington, D.C.: U.S. Government Printing. To do this, the War Finance Committee established a series of programs that enabled the public to loan the government funds that would be used in defense. Known. Buy War Bonds. United States, [Washington, D.C.: U.S. Government Printing Office] Photograph. inmoveclub.ru APA citation style. War Bonds allowed for everyday Americans to invest in the war effort by purchasing bonds that would go up in value over time. Let's take a closer look at these. War BondsWar bonds are a method of financing war that reduces demand for goods and services by taking money out of circulation through investment in the. Israel at War. We Stand With Israel. Israel Bonds has launched an international campaign to raise funds for the Jewish state during this time. INVEST IN. Government & War Stocks & Bonds · - $25 US Savings Bond Series E Washington Punch Card Fed Reserve Cleveland · State of South Carolina Bond Stock. Searching for a bond (Treasury Hunt®). What is Treasury Hunt? Treasury Hunt is our online search tool for finding Treasury Securities or missing interest.